ny paid family leave tax opt out

If you need assistance contact the Paid Family Leave Helpline at 844-337-6303 wwwnygovPaidFamilyLeave. Im a healthy single male in my 20s so I dont see the benefit of.

New York Paid Family Leave Resource Guide

Employees can opt out of Paid Family Leave if they do not expect to work for their employer for this minimum amount of time required for eligibility.

. You will receive either Form 1099-G or Form 1099-MISC. They work 20 hours per week but not 26 consecutive weeks or. Within the first 26 weeks of starting your business you do not face a two-year waiting period.

If the employee satisfies. The cost of this plan will be funded solely by employee deductions. However employers can opt to fund the policy.

While you can opt in at any time you may be subject to a two-year waiting period for taking Paid Family Leave depending on your timing. There are a few instances where an employee can opt-out. Paid Family Leave is a mandatory benefit for employees who do not fall into an excluded class and work at a Covered Employer just like DBL.

You are eligible for Paid Family Leave 26 weeks after you obtain PFL coverage. When practical employees should provide 30 days advance notice of their intention to use Paid Family Leave. Opting Out Payment Rate Schedule Benefit 2022.

Employers must offer employees who will not meet minimum eligibility criteria the choice to opt out by completing a Paid Family Leave waiver which is available at nygovPaidFamilyLeave. Employer must keep a copy of the fully executed waiver on file for as long as the employee remains in employment with the covered employer. NY Paid Family Leave.

Enhanced Disability and Paid Family Leave Benefits. Payment of 67 of your salary for a max benefit of 213672 biweekly for 12 weeks. BOND with a newly born adopted or fostered child CARE for a family member with a serious health condition ASSIST loved ones when a family.

New York State Paid Family Leave provides job-protected paid time off to employees who need time away from work to. Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged. Say Thanks by clicking the thumb icon in a post.

Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax Reference link. Employer must keep a copy of the fully executed waiver on. Paid family leave tax opt out in Washington.

To opt out you may complete a PFL waiver httpswww1nycgovassetsdcasdownloads pdfagenciespfl_waiver_nycpdf and submit it to your Human Resources HR representative. Opting Out of Paid Family Leave 12 NYCRR 380-26 a An employee of a covered employer shall be provided the option to file a waiver of family leave benefits. If your employer participates in New York States Paid Family Leave program you need to know the following.

I am currently remote working from Texas for a company based out of Washington. Paid Family Leave coverage for non-represented employees can be determined by the Public Employer. Employer must keep a copy of the fully executed waiver on file for as long as the employee remains in employment with the covered employer.

They work fewer than 20 hours per week but not 175 days in a consecutive 52-week period. Please see the form at the link below if you want to waive the coverage. The maximum annual contribution is 42371.

Paid family leave is the vacation time you get if you have a new kid or you have a seriously ill family member you need to go take care of. Generally the reason youd want to opt out is that you pay a premium from your paychecks to be covered and waiving it. So if you are an eligible employee working for a Covered Employer then you have to have Paid Family Leave.

New York Paid Family Leave is insurance that is funded by employees through payroll deductions. The maximum employee contribution in 2018 shall be 0126 of an employees weekly wage. You can read more about those excluded classes here.

Can Employees Opt-Out Of NY Paid Family Leave. If you have questions please call Audra Cornelius at 315-792-71947 or email her at cornelalsunypolyedu. An employer may choose to provide enhanced benefits such as.

The Workers Compensation Board has a dedicated. If your employer participates in new york states paid family leave program you need to know the following. Requirements for New York employers.

Unless an employee meets the very specific criteria below and you are a Covered Employer they must participate in Paid Family Leave even if theyve already had children or have no living family and dont. PFL-Waiver - Employee Paid Family Leave Opt-Out and Waiver of Benefits. As a Public employer you may voluntarily opt into New York Paid Family Leave at any time.

Opting-Out Of Coverage In most cases Paid Family Leave PFL is a mandatory benefit for employees who do not fall into an excluded class. In 2016 New York enacted the nations strongest and most comprehensive Paid Family Leave policy so working families would not have to choose between caring for their loved ones and risking their economic security. I When his or her regular employment schedule is 20 hours or more per week but.

These benefits must be secured through a carrier licensed to write New York State statutory disability. If you optedopt in. New York Paid Family Leave is fully funded by employee payroll contributions.

You may request voluntary tax withholding. Your employer will not automatically withhold taxes from these benefits. EMPLOYEE OPT-OUT OF PAID FAMILY LEAVE BENEFITS.

Any benefits you receive under this program are taxable and included in your federal gross income. As part of the program employers are required to purchase a Paid Family Leave insurance policy. Each year the Department of Financial Services sets the employee contribution rate to match the cost of coverage.

Increased monetary pay out a shorter waiting period duration to collect benefits or a longer duration for benefits to be paid. Workers Compensation Advocate for Business. EMPLOYEE CONTRIBUTION Employers may collect the cost of Paid Family Leave through payroll deductions.

Seasonal may opt out of Paid Family Leave. If you will not meet the service requirements for the NYS Paid Family Leave Program you may complete a waiver to opt out of family leave coverage at this time. The weekly benefits and duration will increase slowly maxing out at 12 weeks by January 2021.

Get answers to your questions or other assistance on Paid Family Leave by calling the toll-free Helpline at 844 337-6303. In 2022 the employee contribution is 0511 of an employees gross wages each pay period. Paid Family Leave Helpline.

NY Paid Family Leave. The new york department of financial services announced. A public employer is defined as the State any political subdivision of the State a public authority or any government agency or instrumentality.

Workers compensation advocate for business. I got a payroll deduction for the Washington Paid Family Medical Leave Tax from my paycheck and I was wondering if I could opt out of this. In November 2021 Governor Kathy Hochul signed legislation to further strengthen Paid Family Leave by expanding family care to cover siblings effective.

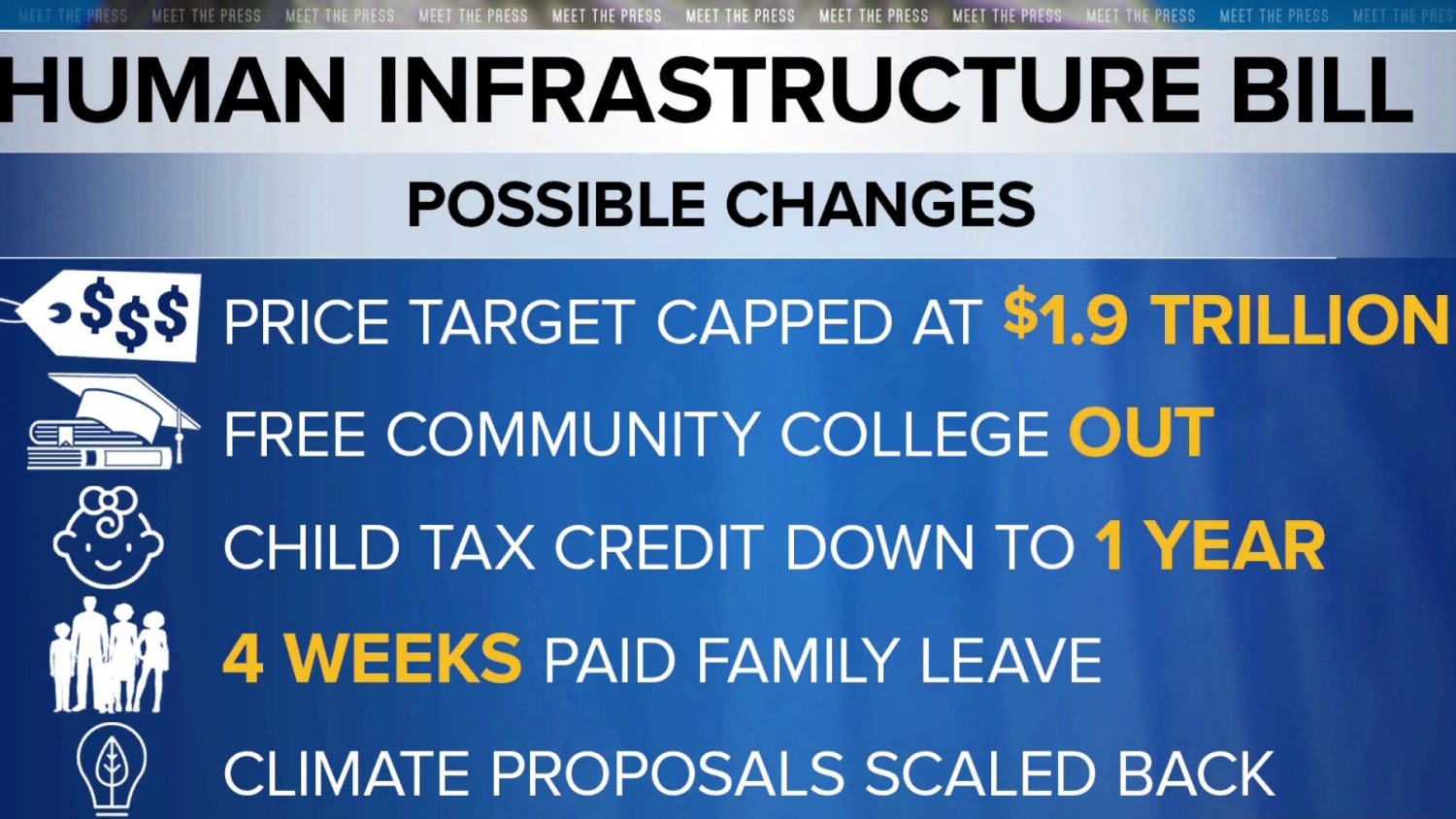

Biden S Child Tax Credit Community College And Paid Family Leave Plans May Be Cut

Ny Paid Family Leave Opting Out Shelterpoint

Cost And Deductions Paid Family Leave

Your Rights And Protections Paid Family Leave

New York State Paid Family Leave Takes Effect January 1 2018 Are You Ready Perlman And Perlman

Get Ready For New York Paid Family Leave In 2021 Sequoia

Nys Paid Sick Leave Vs Nys Paid Family Leave

New York Paid Family Leave Do I Really Have To The Standard

New York State Paid Family Leave Cornell University Division Of Human Resources

Ny Paid Family Leave Opting Out Shelterpoint

Update New York State S Paid Family Leave Program

New York Paid Family Leave Resource Guide

Ny Paid Family Leave Opting Out Shelterpoint